How to link Pan with Aadhaar card: You need to link your PAN card with your Aadhaar card if you want to file your Income Tax returns, open an instant bank account online, and verify tax filings. If you haven’t done it yet, your PAN card will become invalid soon. According to the latest government notification, if taxpayers don’t update their Aadhaar information by March 31st, their PAN card will not be considered valid, and they will have to pay penalties. To avoid this situation, we have created a guide to help you check your Aadhaar-PAN link status, link them online or offline, meet deadlines, pay fees, and more. Please take a look.

How to check if your PAN and Aadhaar Card are linked online

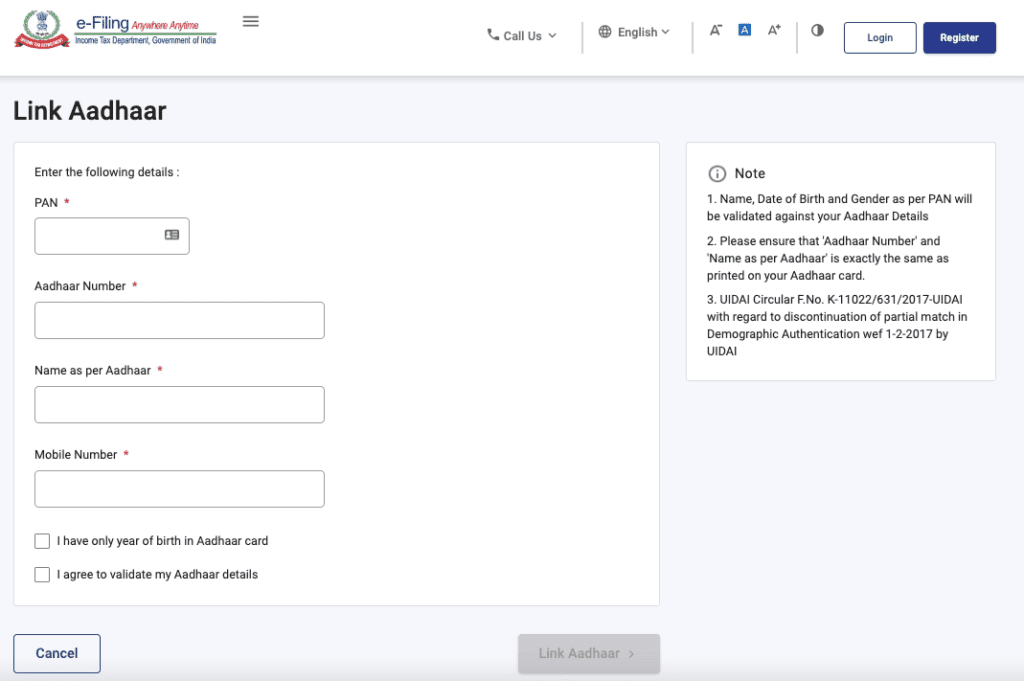

How to link Aadhaar with PAN card online

If you want to connect your PAN card to your Aadhaar card using the internet, you need to have all the necessary papers with you. It’s also important to have your mobile number registered with Aadhaar because you may receive an OTP for verification purposes.

You can also go to https://www.utiitsl.com/ or https://www.egov-nsdl.co.in/ to connect your PAN and Aadhaar.

How to link PAN with Aadhar card via SMS

Moreover, people can connect their PAN and Aadhaar cards through SMS as well. Simply text UIDPAN <SPACE> <12 digit Aadhaar> <SPACE> <10 digit PAN> to either 567678 or 56161, utilizing the mobile number that is already registered.

How to link PAN card with Aadhaar card offline

You can also connect your PAN with an Aadhaar card through an offline process. To do this, you need to visit a PAN service provider center such as NSDL or UTIITSL. You will need to complete an ‘Annexure-I’ form and show supporting documents such as a copy of your PAN card and Aadhaar card. Please note that you will have to pay a certain fee for this service. The online process, on the other hand, does not require any fees.

Can you link Aadhaar with PAN for free?

The last date to connect PAN card with Aadhaar card for free through online mode was March 31st, 2022. If you fail to do so within the deadline, the Income Tax department may impose a fine of up to Rs 1,000. However, your PAN will still be valid for one more year until March 2023 for procedures such as filing ITR, claiming refunds, and other I-T related tasks.

Aadhaar-PAN link FAQs

Q.1 What will happen if you don’t link your Aadhaar card with PAN card?

Ans: If you do not connect your Aadhaar card with PAN, not only will you be unable to file ITR, but your PAN card will also become inactive. Furthermore, if you fail to comply, you may face a higher penalty and be subject to increased TDS or TCS charges.

Q.2 Can I apply for a pan card without Aadhaar?

Ans: If you want to apply for a PAN card online, you must have Aadhaar as the Income Tax department uses information from the Unique Identification Authority of India (UIDAI) to authenticate your identity details and finish the e-KYC process. However, you can still apply for a PAN card without Aadhaar. To do this, you need to send physical copies of your documents, including Voter ID card, driving license, passport, and others, to the Income-tax department for verification.